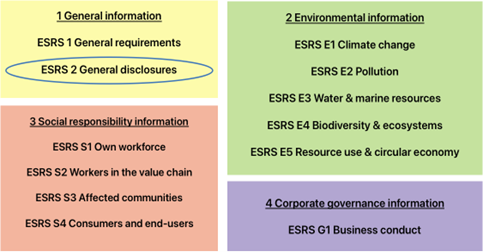

This text is part of the series of brief articles that HållbarTillväxt AB has created to explain, simplify and explore the various steps that are currently most relevant in the area of sustainability; CSRD and ESRS. The ESRS consists of a total of 12 separate documents, 2 of which relate to general and comprehensive information (ESRS 1 and 2). The remaining 10, so-called topical standards, deal with various sustainability issues divided into environment, social responsibility and corporate governance – in English Environment, Social and Governance, abbreviated ESG. Fulfilment of the new requirements in CSRD and reporting according to ESRS is based on the involvement of all functions in a business, including the board and management. The board is ultimately responsible for sustainability reporting just as it is for financial reporting. Like the financial report, the sustainability report must now also be reviewed by an external auditor.

ESRS 2 – General disclosures is part of the European Sustainability Reporting Standards (ESRS) and is an overarching standard that applies to all companies that must report according to CSRD, regardless of the industry the company operates in. The purpose of the standard is to create a framework for the preparation of the sustainability statement with the aim of increasing transparency and comparability in sustainability reporting between European companies. This enables investors and other stakeholders to understand the companies’ sustainability work and performance as well as their longer-term risks and opportunities. The standard has disclosure requirements for several key areas including corporate governance, risk management, due diligence, strategy and reporting principles. In this way, ESRS 2 ensures that companies provide a clear and consistent description of their sustainability-related strategies, processes and results. The central aspects of ESRS 2 – General disclosures will be explained in this article.

Key concepts

ESRS 2 outlines the required structure for the sustainability report, detailing how accounting principles and assumptions should be described, and defining the concepts that are consistently applied across the ESRS topical standards.

Sustainability deceleration: The company’s sustainability report. The special section in the company’s management report where the information on sustainability issues prepared in accordance with European Parliament and Council Directive 2013/34/EU37 and ESRS is presented.

Sustainability matters: The environment, social rights and human rights (social responsibility) and (corporate) governance factors. In ESRS standards, all subjects, sub-topics and sub-sub-topics can be referred to as sustainability matters.

Double Materiality: The double materiality consists of two parts, impact materiality and financial materiality. A sustainability matter can be significant both from an impact and financial perspective.

- Financial Materiality: A sustainability matter is material from a financial perspective if it involves risks or opportunities that affect (or can reasonably be expected to affect) the company’s financial position, financial results, cash flows, access to financing or capital costs in the short, medium or long term.

- impact Materiality: A sustainability matter is material from an impact perspective when it relates to the company’s significant, actual or potential, positive or negative impacts for people or the environment in the short, medium and long term. Significant impacts can be linked to the company’s own operations, downstream or upstream in its value chain, also through its products and services, as well as through its business relationships.

Business model: The company’s system for converting inputs through its operations into output and results, a system that aims to fulfil the company’s strategic objectives and create value in the short, medium and long term. In ESRS, the expression business model is also used in the singular, even though many companies have several different business models. The business model visualises transactions, i.e. how a company makes money.

Value chain: The company’s value chain includes all activities, resources and connections related to the business model and consists of actors both earlier (upstream) and later (downstream). This includes external operations that the company uses and relies on to create its products and/or services. From the idea stage to delivery, consumption and end of life. This also includes raw material extraction, transport, use of products and services and recycling. In ESRS, the term value chain is used in the singular even though most companies have several value chains. A value chain typically visualises material flows, i.e. how a material is extracted, developed, used and then reused.

The administrative, management and supervisory bodies: The governing bodies that have the highest decision-making authority in the company, including its committees. If there are no members in the company’s governance structure, the CEO and, where applicable, the deputy CEO should be included. In some jurisdictions, the governance systems consist of two levels, where supervision and management are separated. In such cases, both levels are included in the definition of administrative, management and supervisory bodies. This applies, for example, to the board and group management of a Swedish limited liability company.

IRO: IRO stands for impact, risks and opportunities, and is a central part of reporting according to ESRS. It is here that the company evaluates the impact activities in the value chain have or can have on people and the environment as a result of the company’s activities or business relationships. Here, the impact that various sustainability issues have or can have on the company is also assessed. In this relevance assessment of all sustainability issues, it is important to start from gross risks and opportunities, i.e. before taking action.

Stakeholders: There are two main groups of stakeholders within the ESRS:

- Affected stakeholders: individuals or groups whose interests are affected or could be affected – positively or negatively – by the company’s operations and its direct and indirect business relationships across the value chain.

- Users of sustainability statements: primary users of general purpose financial reporting (for example, existing and potential investors, lenders and other creditors), as well as other users, including the company’s business partners, trade unions and social partners, civil society and non-governmental organisations, government administrations, analysts and academics.

Some stakeholders belong to both groups.

Stakeholder dialogue: An ongoing process of interaction and dialogue between the company and its stakeholders that allows the company to become aware of and understand the stakeholders’ interests and concerns, which creates opportunities to address them.

Due diligence: Sustainability due diligence is the process that companies carry out to identify, assess, prevent, mitigate and remediate the actual and potential adverse impacts connected with its operations, products or services through its own activities and across the value chain. Due diligence is a continuous practice that reflects and may lead to changes in the company’s strategy, business model, operations, business relationships, function, raw material assets and sales. This process is described in the international instruments of the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises.

Photo: Kraken images, Unsplash

What should be reported?

ESRS 2 – General information requires the company to provide a clear and comprehensive picture of its sustainability strategies, governance structures, significant sustainability risks and opportunities as well as reporting principles and methods. The report begins with a description of the general foundation for the preparation of the sustainability statements. Here you will find, among other things, information about the scope of the consolidation, information about the value chain (both upstream and downstream) and information with regard to special circumstances, for example if you have deviated from definitions of time horizons or if you have sources of uncertainty in estimates and outcomes due to of certain assumed measurements and calculation methods.

In the next part of the report, the company must give an account of its organisational structure and governance structure. The company must provide information on the role that administrative, management, and supervisory bodies play in sustainability efforts and explain how sustainability matters are integrated into the company’s governance, such as through the due diligence process. Information must be presented regarding the individuals who make up its governing body and, in addition, which roles and responsibilities these persons hold. Furthermore, the company must report on its sustainability strategies and goals. The company must provide a detailed description of its overall sustainability strategy and how this strategy is integrated into the company’s business model. The company must also show how the company’s stakeholders interests, needs and opinions are taken into account in the company’s strategy and business model and the outcome of the company’s assessment of essential impacts, risks and possibility, including how they inform its strategy and business model.

Finally, in this first chapter of the Sustainability Report, according to ESRS 2, the company must describe how it manages impacts, risks and opportunities. This means an explanation of the process for identifying significant impacts, risks and opportunities that the company uses. The company must also provide information about the disclosure requirements included in the company’s sustainability statement and about the topics that have been omitted as non-essential as a result of the materiality assessment, the so-called double materiality assessment. To ensure transparency and comparability in the reporting, the company should partly describe how the materiality assessment was carried out, and partly describe the principles and methods used to collect, analyse and report sustainability data. This includes a description of the internal and external sources of data, the methods used to ensure the reliability and accuracy of the information, and the systems and processes used to collect, calculate and manage sustainability information.

The company must also indicate whether it follows any external standards or frameworks for sustainability reporting, such as GRI (Global Reporting Initiative) or ISSB (International Sustainability Standards Board), and how these standards are applied in its reporting. It is important to clearly account for any changes in reporting methods or assumptions that may affect the comparability of data over time. With regard to comparisons between years, it is perfectly possible to use the first reporting year as the base year, i.e. not report the previous period for the first year’s reporting. In cases where the company has previously reported data in some area, for example in personnel data or climate-related information, this must be described and, where applicable, a description of changed definitions, assumptions or calculation methods is needed.

© HållbarTillväxt AB 2024