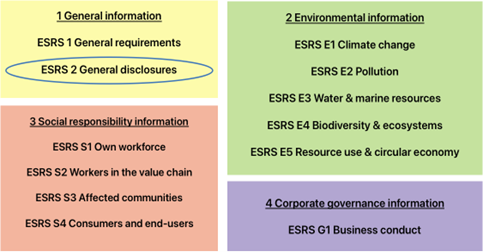

This text is part of the series of brief articles that HållbarTillväxt AB has created to explain, simplify and explore the various steps that are currently most relevant in the area of sustainability; CSRD and ESRS. The ESRS consists of a total of 12 separate documents, 2 of which relate to general and comprehensive information (ESRS 1 and 2). The remaining 10, so-called topical standards, deal with various sustainability issues divided into environment, social responsibility and corporate governance – in English Environment, Social and Governance, abbreviated ESG. Fulfilment of the new requirements in CSRD and reporting according to ESRS is based on the involvement of all functions in a business, including the board and management. The board is ultimately responsible for sustainability reporting just as it is for financial reporting. Like the financial report, the sustainability report must now also be reviewed by an external auditor.

Due diligence, within the framework of sustainability reporting, is the process that companies use to identify, prevent, limit and report how they manage actual and potential negative impacts on the environment and people connected to their business operations. This involves the company’s impact on topics such as working conditions, child and forced labour, emissions of greenhouse gases, waste management, resource use or pollution of the environment through its own operations or across the value chain. The concept of due diligence is based on international guidelines such as the UN’s Guiding Principles on Business and Human Rights and the OECD’s Guidelines for Multinational Enterprises. The principle is a central aspect of reporting according to CSRD and ESRS and will be explained in more detail in this article.

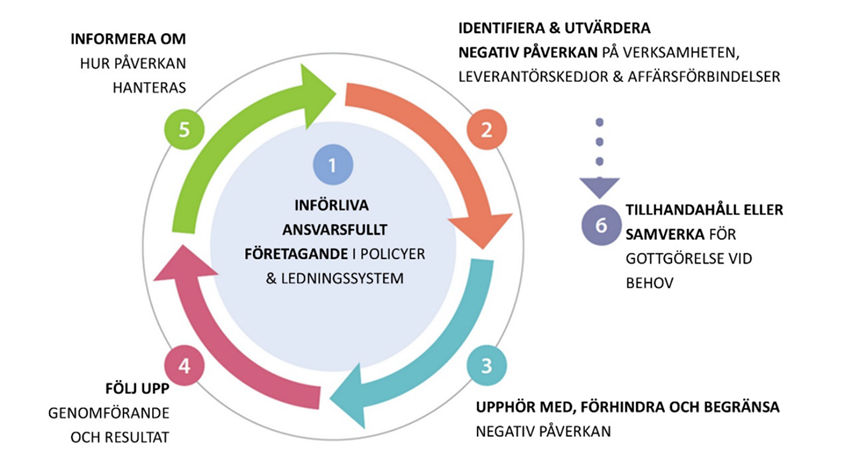

The Due Diligence process

The due diligence process consists of several steps and covers the entire value chain, including the company’s operations, its products and services, and its business relationships. It is a continuous practice that can lead to changes in the company’s strategy, business model, operations, business relationships, raw material assets and sales. The central parts of the process include:

- Identification and assessment of negative impacts:

- The company identifies and assesses negative impacts for people and the environment arising from their operations and value chain. This includes both direct and indirect effects. The process includes mapping potential risks and impacts and prioritising measures based on how serious and likely these impacts are.

- Integration in governance and strategy:

- Due diligence should be integrated into the company’s governance, strategy and business model. This means that sustainability matters are taken into account in strategic decisions and that the board and management are actively involved in these matters.

- Cooperation with stakeholders:

- The company must collaborate with affected stakeholders to understand their perspective and take their views into account in the sustainability work. This commitment is critical to effectively identifying and managing sustainability risks and opportunities.

- Actions to address negative impacts:

- The company takes concrete measures to manage and reduce the identified negative impacts for people and the environment. The measures may include adaptation plans and other strategies to reduce negative impacts and improve sustainability results.

Picture: OECD Guidelines

Due diligence within ESRS 2

ESRS 2 – General disclosures is the topical standard within ESRS that lays the foundation for the preparation of the sustainability statement and must be reported on by all companies covered by CSRD. This standard sets specific requirements on how companies must report on, among other things, their processes and results within due diligence. The following disclosure requirements within ESRS 2 reflect the key elements of due diligence:

- According to ESRS 2, companies must report how due diligence is integrated into their governance and strategy. This describes what process you have for due diligence and which parts of the value chain are covered and which decision-making bodies are responsible.

- Companies must report on how they cooperate with stakeholders and take into account their interests and views along the value chain.

- Companies must describe their processes to identify and assess negative impacts on people and the environment.

Companies must disclose the measures they are taking to address these impacts, including specific transition plans (ESRS 2 MDR-A, topical ESRS). It must also be clarified whether there are targets and how, if so, these are followed up.

Corporate Sustainability Due Diligence Directive – CS3D

CS3D, also formulated as CSDDD, stands for the Corporate Sustainability Due Diligence Directive and is a directive from the EU that deals with and sets special requirements for due diligence. Unlike CSRD, which only demands transparency and reporting from companies, CS3D instead demands that companies actually take measures and act according to special principles in their operations and across the value chain to limit, reduce and even restore negative impacts that the company activities have caused across the value chain.

- CS3D is an EU legislation. It was voted through in March 2024 and received an official version later in July of the same year. The directive aims to ensure that companies identify, prevent, alleviate and report how they manage negative impacts on human rights and the environment in their own operations and across the value chain. CS3D complements other EU initiatives such as the Corporate Sustainability Reporting Directive (CSRD) by focusing on due diligence processes. The directive primarily encompasses three distinct categories of companies, each with varying extended phase-in periods based on their size. These groups include:

- Companies within the EU with 1,000+ employees and a global net turnover of over 450 million euros.

- Non-EU companies with a net turnover of over EUR 450 million within the EU.

- Parent company of a group that meets these thresholds, even if the parent company itself does not individually meet them.

It is important to start preparing for CS3D well in advance. Companies with more than 5,000 employees and a net turnover of EUR 1,500 million must work in accordance with CS3D as early as 2027. For slightly smaller companies with more than 3,000 employees and EUR 900 million in net turnover, CS3D applies from 2028. For the remaining companies covered by the directive, those with 1000+ employees and more than 450 million euros in net sales, must comply with CS3D by 2029.

© HållbarTillväxt AB 2024