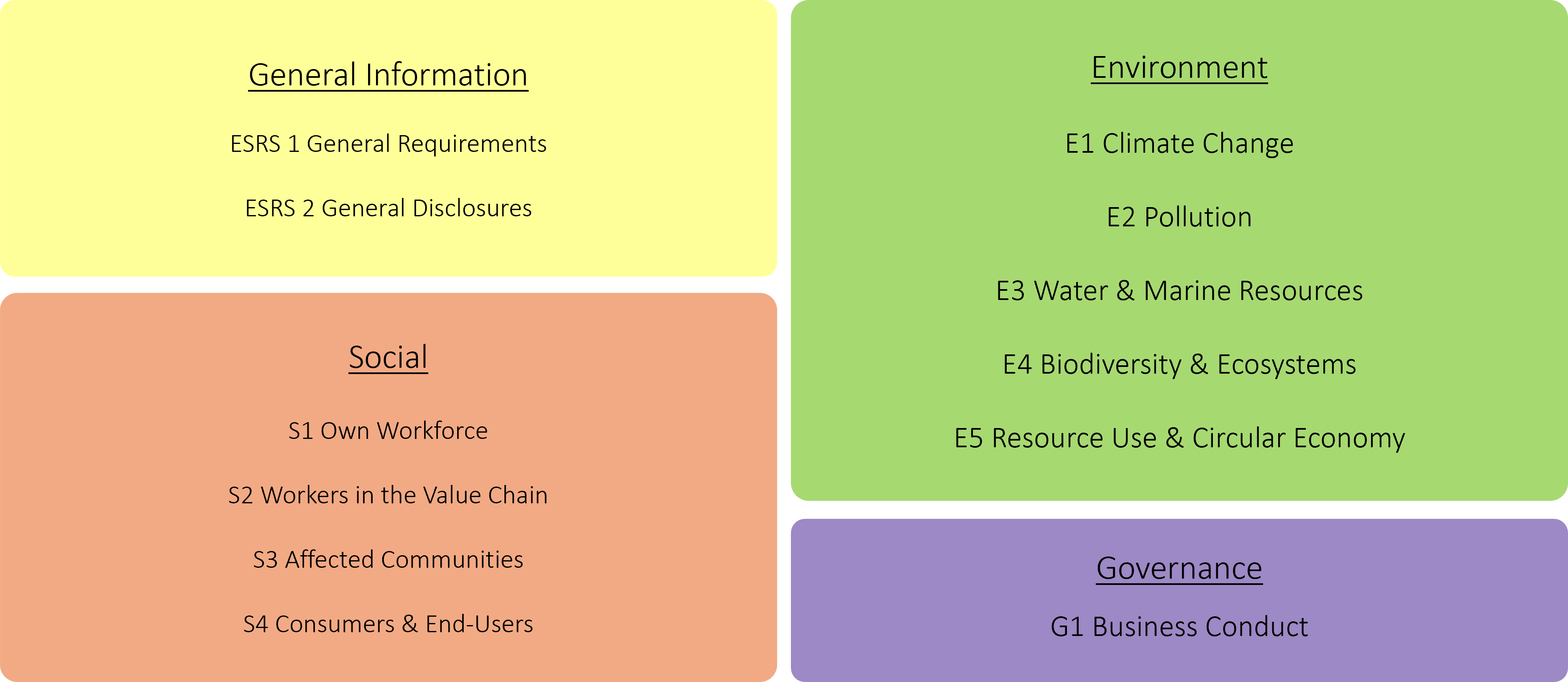

This text is part of the series of brief articles that HållbarTillväxt AB has created to explain, simplify and explore the various steps that are currently most relevant in the area of sustainability; CSRD and ESRS. The ESRS consists of a total of 12 separate documents, 2 of which relate to general and comprehensive information (ESRS 1 and 2). The remaining 10, so-called topical standards, deal with various sustainability issues divided into environment, social responsibility and corporate governance – in English Environment, Social and Governance, abbreviated ESG. Fulfilment of the new requirements in CSRD and reporting according to ESRS is based on the involvement of all functions in a business, including the board and management. The board is ultimately responsible for sustainability reporting just as it is for financial reporting. Like the financial report, the sustainability report must now also be reviewed by an external auditor.

The double materiality assessment (DMA) serves as the foundation for defining the scope of a company’s sustainability report. This assessment identifies the sustainability issues that are critical to each specific company and business. The key sustainability matters identified through this process determine which topical standards apply to the company and must be included in the report. It’s important to note that the review process examines both the content of the Sustainability Report and the underlying rationale that shaped it. Auditors, therefore, seek to evaluate both the relevance and materiality assessment that guided the report’s scope. Additionally, it must be disclosed how management and the board have participated in this process.

The double materiality assessment is grounded in a thorough mapping of a company’s business model and value chain. This process begins by identifying all relevant sustainability matters outlined in the ESRS topical standards, focusing on those areas where the company’s operations and value chain have, or could potentially have, a significant impact on the environment or society. “Sustainability matters” refers to all topics, sub-topics, and sub-sub-topics outlined in the ESRS. The first step involves assessing which sustainability matters are or may be relevant in terms of impact materiality, financial materiality, or both.

If a sustainability matter is deemed essential for the company, the related topical standard must be reported on in the sustainability report. When reviewing the work with the double materiality assessment, transparency in how the assessments are carried out and justified is crucial. For instance, if a company determines that a sustainability matter is non-material, it must provide a documented justification explaining this decision and consider whether the matter could become material in the future. Ultimately, sustainability reporting allows investors and stakeholders to compare the long-term sustainability of different companies.

Double Materiality

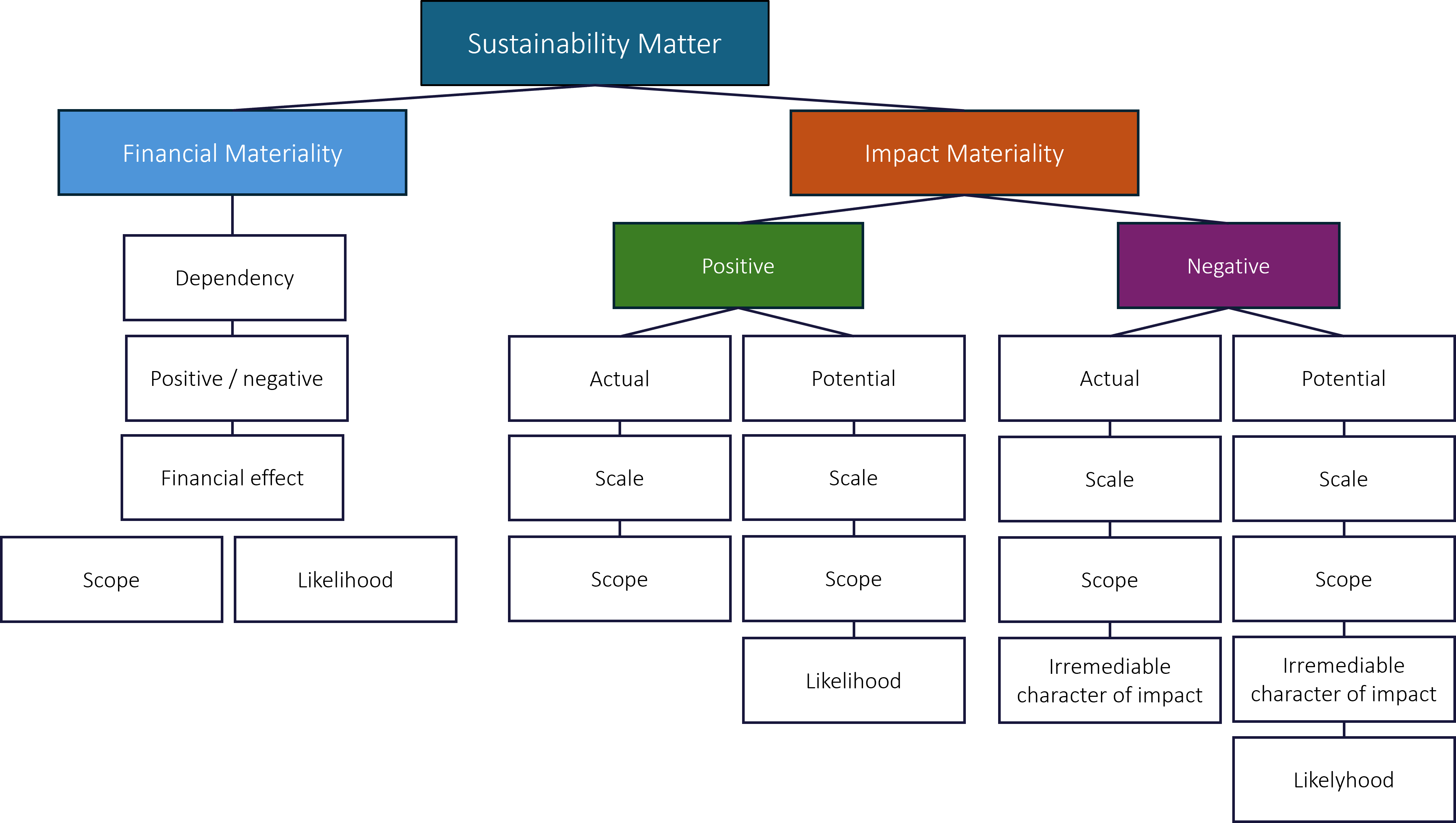

Assessing ‘double’ materiality means assessing a sustainability matter both in terms of its financial materiality as well as its impact materiality. The materiality assessment must also take into account the needs of affected stakeholders. This usually takes place in a so-called stakeholder dialogue. The company may have contact with affected stakeholders or their representatives (such as employees or trade unions), and other experts, who provide evidence or feedback on the company’s conclusions regarding significant impacts, risks and opportunities. The stakeholders are therefore central in the double materiality assessment. Stakeholders can be employees and other workers, suppliers, consumers, customers, end users, local communities and vulnerable groups, and authorities. On the environmental side, it can be more difficult with a pronounced stakeholder dialogue. Nature is considered a silent stakeholder. In that case, environmental impact statements, scientific reports, ecological data and information on the conservation of species can form the basis of the company’s materiality assessment.

Impact materiality refers to a company’s significant, actual or potential, positive or negative impacts on people or the environment over the short, medium, and/or long term. Significant impacts can be linked to the company’s own operations and either upstream or downstream in its value chain, or through its products and services and through its business relationships. As a basis for the materiality assessment of a negative impact, the due diligence process defined in the international instruments of the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises is used, which you can read more about here. Identified impacts are evaluated and reported differently depending on whether it is an actual or potential impact and whether the impact is positive or negative. For actual negative impacts, materiality is based on the severity of the impact, while for potential negative impacts it is also based on the likelihood of the impact occurring. Severity is based on the scale, extent and reversibility of the actual or potential impact. This is about how severe the negative impact or how beneficial the positive impact is for people or the environment, how widespread the impacts are and for negative impacts, how easy it is to reverse their effects. In the event of potential negative impacts on human rights, the severity of the impact is considered before its likelihood. For scale, scope and recoverability as well as for probability, there are no fixed guidelines or thresholds specified in the ESRS. Instead, companies themselves must develop, justify and use these in a consistent manner in their materiality assessment. Positive impacts are treated similarly. For actual positive impacts, materiality is based on the scale and scope of the impact, while potential positive impacts are also based on probability.

A sustainability matter is essential from a financial perspective if it triggers or can reasonably be expected to trigger material financial effects on the company. This is the case when a sustainability matter generates risks or opportunities that have a material impact, or can reasonably be expected to have a material impact, on the company’s development, financial position, financial results, cash flows, access to financing or capital costs in the short, medium or long term. Risks and opportunities can arise from past events or future events. The financial materiality of a sustainability matter is not limited to issues within the company’s control, but includes information about material risks and opportunities attributable to business relationships beyond the scope of consolidation used when the financial statements are prepared. Dependencies on, for example, natural resources, human resources or community resources are typical sources of financial risks or opportunities. Dependencies can affect the company’s ability to continue to use or obtain the resources needed for its business processes, as well as the quality and pricing of these resources. They can also affect the company’s ability to rely on business relationships needed in business processes on acceptable terms. The materiality of risks and opportunities is assessed based on a combination of how likely they are to occur and the potential extent of the financial effects. For example, some businesses may depend on water, making the resource a significant risk if the availability, quality or price of water suddenly changes dramatically.

When a company performs a double materiality assessment, each sustainability matter is assessed separately with respect to the criteria of impact and financial materiality. In the event that a sustainability matter is determined to be impact or financially material or both, the company must report on the disclosure requirements and associated data points that are linked to the topical and sector-specific ESRS. It includes the company’s upstream and downstream value chain in addition to its own operations.

For example, a company working in agriculture may assess that it significantly affects biodiversity in the areas where it operates through its land use or pesticide use, making it essential to report on ESRS E4 – Biodiversity and ecosystems and its sub-topics and sub-sub-topics. When the company identifies and assesses the impacts, risks and opportunities in its value chain to determine materiality, it must focus on areas where it is judged likely to arise, due to the nature of the operations, business relationships, geographical factors or other relevant risk factors.

The double materiality assessment should be integrated into a company’s regular assessment process for both risks and opportunities within different time horizons so that sustainability work can become an integral part of a company’s development and growth, not just a reporting burden. This work is repeated annually and depending on changes in the market, customers and the outside world, the assessment may differ from year to year. An example is the dependence on different materials and the supplier landscape. Its availability is affected by unrest in the world, transport routes as well as demand and climate impact.

© HållbarTillväxt AB 2024

PDF: CSRD Readiness DMA